28+ put debit spread calculator

Never before has there. Enter the underlying asset price and risk free rate Step 3.

News Hed

This drastically reduces your risk while increasing your profit potential.

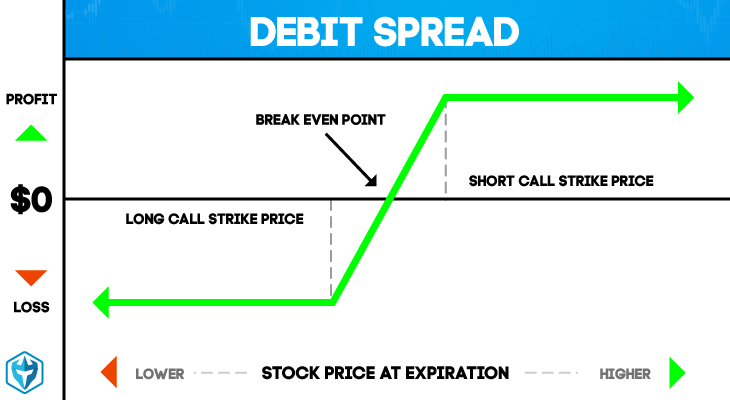

. Web A debit spread or a net debit spread is an options strategy involving the simultaneous buying and selling of options of the same class with different strike prices. Web Put Option Spread. ConversionArb Reverse ConversionArb Long BoxArb Short BoxArb Ratio Call21 Ratio Put21 Call Back.

Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options. Web A Bear Put Debit Spread is a risk defined and limited profit strategy. Web A debit spread is a type of options trading strategy that consists of simultaneously buying and selling options with the same underlying asset but different.

Web A bear put debit spread is a multi-leg risk-defined bearish strategy with limited profit potential. Select your option strategy type Call Spread or Put Spread Step 2. The goal is for the stock to.

Your source for the latest on options and the most innovative companies to invest in. It is an options strategy that is used when the investor expects a moderate drop in the price of. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Web A put debit spread is a bearish options trade with a defined max profit and loss. It combines a short and a long put which caps the upside but also the downside. Ad Since 2005 The Slope of Hope Has Been The Go-To Site For Traders Who Love Charts.

The next two columns H and I show the value and profit or loss at given underlying price at expiration. The max profit achievable is greater than the max loss. Web This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options.

The strategy looks to take advantage of a price. Web A bear put spread option is 2 contracts between a buyer and seller. Ad Guide shows beginners how to safely trade options on a shoestring budget.

Learn More About American Funds Objective-Based Approach to Investing. Research Fund Options That Fits Your Investment Strategy. Web Short Call Condor Spread.

Come check out the most powerful tools for traders and learn from the community. Get Started In Your Future. It is constructed by purchasing a put and selling a lower strike put against it within.

Web Bull call spread is a debit spread we pay 708 when setting up the position. The maximum profit is achieved when the price. Web Instead Debit Spreads can serve as a better alternative because they require low capital and can be performed on any stocketf that supports options.

Short Put Condor Spread. Web When using Debit Spreads you can sell an option at the same time as you buy. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Bear put spreads are debit spreads that consist of buying a put. Enter the maturity in days of the strategy. Web Bull call spreads are debit spreads that consist of buying a call option and selling a call option at a higher price.

Web A bearish vertical spread strategy which has limited risk and reward. Learn How To Trade Options Like The Pros.

Debit Spreads Explained Trade Options With Me

Bull Call Spread Calculator Optionstrat Options Trade Visualizer

Debit Spread Definition Day Trading Terminology Warrior Trading

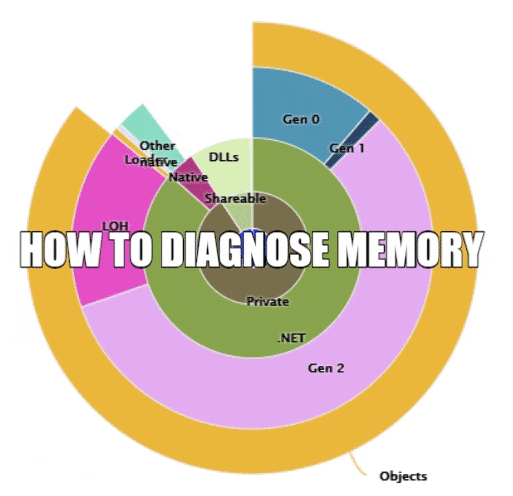

Mike Volodarsky S Blog Fixing W3wp Exe Memory Leaks Is Easier Than You Think

Intraday Trading Jargon Made Easy Share India Blog

Revolut Business Everything You Need To Know Swoop Uk

Basics Of Corn Production In North Dakota Ndsu Agriculture And Extension

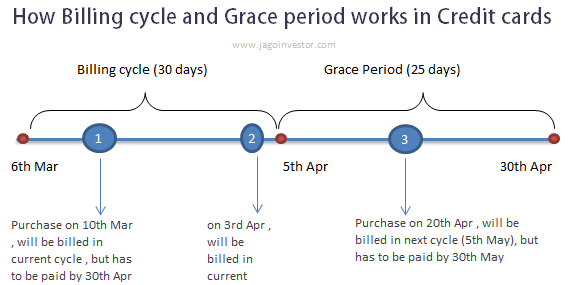

Minimum Balance In Credit Card How Does It Work

Next Steps For Admitted Freshmen By Tarleton State University Issuu

Credit Spread Calculator Incometrader Com

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Using The Free Trade Calculator To Profit On Call And Put Spreads Option Party

Instantaneous Velocity Calculator Online Solver With Free Steps

Culture Personio

Options Spread Calculator

Debit Spreads Vs Credit Spreads Youtube